I get lots of questions from readers asking whether they should should get the cash back card from Citi or the Chase Freedom Visa®. I will tackle this issue in this post. I’ll start off with stating that both cards are cash back cards that have very similar features and their differences are subtle and are found in their online shopping mall and their reward programs. Below is a table highlighting both features.

| Cards |  |

|

| 5% Rotating Category | Yes | Yes |

| Online Shopping Portal | Citi Bonus Cash Center Online, Offline Phone and Catalog Merchants |

Ultimate Rewards Mall Online Merchants Only |

| Type Of Card | Cash Back | Cash Back & Rewards |

| Annual Fee | $0 | $0 |

Rotating Categories – Both cards share a lot of similarities. Firstly, they offer cardholders a 5% rotating category where consumers can earn 5% rebates on certain types of expenses each quarter. Their expense types differ slightly and this is one area where consumers will want to check before they apply for either card. The good thing about the Chase Freedom is that they clearly identify their expense category for the whole year in advance. See this years Chase Freedom rotating categories. Citi, on the other hand, only show you the present categories for the present quarter. One thing to note is that the categories change from year to year, so there is no such thing as “this card has a better category”. But rather, it is more a situation whereby you can say “based on my spending habits”, this card will probably let me earn more rebates simply because of the type of expenses in their rotating category buckets.

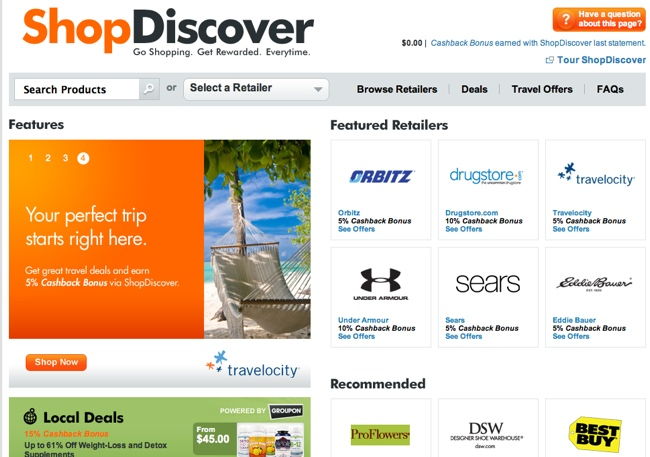

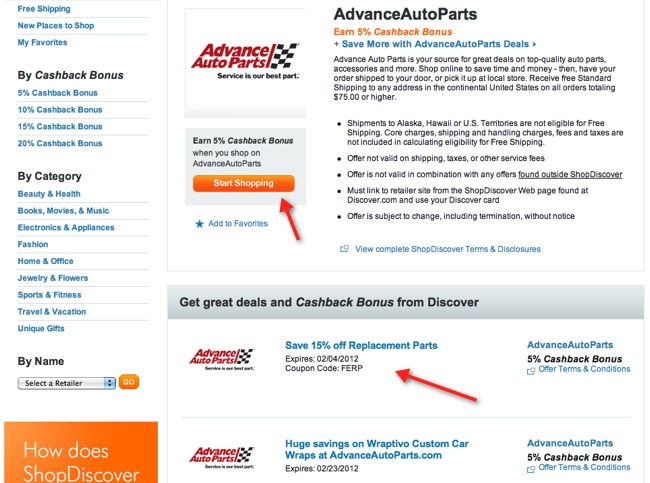

Online Shopping PortalThe other similarity both these cards have is that they have online shopping portals. As an introduction, these online shopping portals have merchant partners. If you log into your account and shop online with their merchants through the portal with your credit card, you will be able to earn extra points or rebates.

Chase’s portal is their Ultimate Rewards Mall. Cardholders can earn extra points when they shop with their merchant partners. The Ultimate Rewards Mall let you earn extra points and not rebates. The reason is that cardholders of Chase Freedom can earn points that can be converted to cash rebates or rewards. According to our latest study on the Ultimate Rewards Mall, Chase has got 360 partners. Off these partners, 91 of them pay the highest rebates or matches the highest rebates paid when merchants are present in other partners as well.

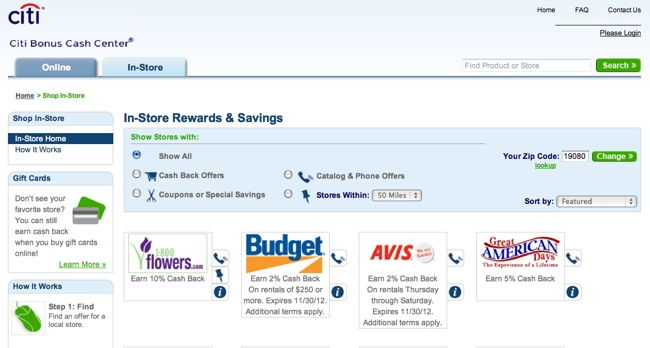

Citi’s portal is called Citi Bonus Cash Center. According to our recent survey, they have the most number of merchants (594) among all credit card online shopping portals. Out of their 594 merchants, 207 merchants provided the highest rebates when you shop from Citi’s portal. In addition to online partners, Citi also has offline partners (some are the same as the online partners) whereby you can earn rebates shopping at their physical stores, over the phone or even their catalogs. In almost all aspects, the Citi Bonus Cash Center is a better online shopping portal than Ultimate Rewards. Since it is a dedicated shopping portal, you can rebates (not points) with Citi.

Ultimate Rewards Is A Full Suite Reward Program – The real difference between the two cards is the fact that while Citi Bonus Cash Center is merely a online (and off line) shopping portal, cardholders of Chase Freedom get to enjoy the full Ultimate Rewards program. That means the points they earn can be converted to cash rebates (just like the Citi Dividend), but it can also be used to redeem other rewards like gift cards, merchandise and even travel rewards through their online travel booking tool.

Furthermore, cardholders who hold both the Chase Freedom Visa® and Chase Sapphire Preferred(SM) Card can combine their Ultimate Reward Points. That means that the points earned from Chase Freedom can be transferred to the Sapphire Preferred account where you can “transfer points to airline and hotel partners”.

Hence, in a way, the Chase Freedom Visa® is not just a cash back card, but rather a hybrid cash back and rewards card.

So Which Card Is Better? – After looking at these two cards in detail, I would say that each has it’s own strong points. They are similar in many ways. They are first and foremost, cash back cards. They have 5% rotating categories and an online shopping mall. If you area an avid online shopper and are always looking out for deals and discounts, you may veer towards the Citi because their Bonus Cash Center has got more merchants than any other shopping portal. They also have partners where you can shop over the phone, in store or with their catalogs. From this perspective, the Citi is the better card.

But the Chase Freedom Visa® also has it’s strong points. The most obvious one is its’ flexibility. It is both a cash back and a rewards card. For those who would like the option to earn either cash back or travel rewards, this card would make a better choice. Furthermore, when Ultimate Reward points are combined with the Chase Sapphire Preferred(SM) Card, points can be transferred to airline and hotel partners. It also means that cardholders who have both the Chase Sapphire Preferred and Freedom will be able to earn points faster through the Freedom’s rotating categories and Ultimate Rewards mall, also also through the double points on the Sapphire Preferred through restaurant and travel spending.

So depending on your priorities, either card should be able to find a home in your wallet. Or even perhaps both, since they have no annual fees and having both in your wallet allows you to truly maximize cash rebates you earn by using the appropriate card at the right time.

Amex Black Card – Given that he was even wondering if his credit card still works, it is highly unlikely that that he carries the Amex Centurion. He is a democrat, and has a more left and liberal leaning opinion. Hence carrying one of the ultimate status symbols of the “1%” ain’t going to look too good. So I think we can rule out this card. Since he will be flying Air Force One and staying in the best hotels guarded by his secret service agents, none of the perks like Ritz Carlton room upgrades, lounge access is going to matter to him.

Amex Black Card – Given that he was even wondering if his credit card still works, it is highly unlikely that that he carries the Amex Centurion. He is a democrat, and has a more left and liberal leaning opinion. Hence carrying one of the ultimate status symbols of the “1%” ain’t going to look too good. So I think we can rule out this card. Since he will be flying Air Force One and staying in the best hotels guarded by his secret service agents, none of the perks like Ritz Carlton room upgrades, lounge access is going to matter to him. Visa Black Card – One again, I doubt that this was the card he was using. There was some dash of white or silver color on the card and the Visa Black card is literally all black. Since Visa Black is supposedly targeted at very few folks (but it seems having a five figure W2 qualifies) and cost $450 in annual fee, I doubt Barack Obama will be seem using this card.

Visa Black Card – One again, I doubt that this was the card he was using. There was some dash of white or silver color on the card and the Visa Black card is literally all black. Since Visa Black is supposedly targeted at very few folks (but it seems having a five figure W2 qualifies) and cost $450 in annual fee, I doubt Barack Obama will be seem using this card. Delta Reserve Card – One again, I doubt the President would be caught carrying an elite $450 credit card. There is a blue Amex logo at the bottom right of the card and I did not see it in the video. He flies Air Force One and does not need the MQMs to get the Silver Elite Status! His bags fly free as well.

Delta Reserve Card – One again, I doubt the President would be caught carrying an elite $450 credit card. There is a blue Amex logo at the bottom right of the card and I did not see it in the video. He flies Air Force One and does not need the MQMs to get the Silver Elite Status! His bags fly free as well. Alaska Airlines Visa – This is a possibility as there is a dash of white on the card (which is black). One would presume that as a Senator in Chicago, he might have used this card to rack up some Alaska Airlines Mileage Plan miles.

Alaska Airlines Visa – This is a possibility as there is a dash of white on the card (which is black). One would presume that as a Senator in Chicago, he might have used this card to rack up some Alaska Airlines Mileage Plan miles. Virgin Atlantic Amex Card – The Virgin Amex Black card is another possibility. But the only problem is that I doubt Obama would be saving miles to fly to London or Europe. Who knows, he might have taken advantage of past 50,000 bonus miles sign up? But I think we can rule out this card because I did not see the Blue Virgin Logo and Amex Logo on Obama’s card.

Virgin Atlantic Amex Card – The Virgin Amex Black card is another possibility. But the only problem is that I doubt Obama would be saving miles to fly to London or Europe. Who knows, he might have taken advantage of past 50,000 bonus miles sign up? But I think we can rule out this card because I did not see the Blue Virgin Logo and Amex Logo on Obama’s card. Asian Amex Card – Yes the card is blackish. But I really cannot imagine Obama saving Asiana miles to fly to Korea? Perhaps he is savvy enough to use the points with alliance airline partners (highly unlikely). There also isn’t any Blue Amex Logo on Obama’s card, so I think we can rule out this one.

Asian Amex Card – Yes the card is blackish. But I really cannot imagine Obama saving Asiana miles to fly to Korea? Perhaps he is savvy enough to use the points with alliance airline partners (highly unlikely). There also isn’t any Blue Amex Logo on Obama’s card, so I think we can rule out this one. Overstock Credit Card – Overstock’s new credit card comes in black color. Perhaps the President is a bargain hunter and likes to get stuff on sale and discounts. This one might just be a possibility although I have to wonder where does he find the time to be surfing the net for bargains? Perhaps the First Lady does all the online shopping?

Overstock Credit Card – Overstock’s new credit card comes in black color. Perhaps the President is a bargain hunter and likes to get stuff on sale and discounts. This one might just be a possibility although I have to wonder where does he find the time to be surfing the net for bargains? Perhaps the First Lady does all the online shopping? Sony Credit Card – Sony’s card is also black in color. Perhaps the President unwinds by playing lots of Playstation games and he earns reward points with the card buying their games. He also might have used his points to get a Sony Plasma TV as well! This card is definitely a possibility.

Sony Credit Card – Sony’s card is also black in color. Perhaps the President unwinds by playing lots of Playstation games and he earns reward points with the card buying their games. He also might have used his points to get a Sony Plasma TV as well! This card is definitely a possibility. Adventium Card – Yikes. This is a subprime card that is issued by First Premier Bank. It is black, presumably to give the illusion that it is a prestige card and on the hopes that folks with bad credit are more likely to apply because of the “black color”. I really do not think the President will be using Aventium and I certainly hope not. I would assume that he was have a decent credit score and the nation would be shocked if he had bad credit!

Adventium Card – Yikes. This is a subprime card that is issued by First Premier Bank. It is black, presumably to give the illusion that it is a prestige card and on the hopes that folks with bad credit are more likely to apply because of the “black color”. I really do not think the President will be using Aventium and I certainly hope not. I would assume that he was have a decent credit score and the nation would be shocked if he had bad credit! BOA Business Charge Card – The dark grey color of the card sure looks like the one the President is carrying. Although why he would actually get a business charge card puzzles me. Perhaps he has an account with BOA? Or maybe he used to have a small business (doubt it because we would all know by now?).

BOA Business Charge Card – The dark grey color of the card sure looks like the one the President is carrying. Although why he would actually get a business charge card puzzles me. Perhaps he has an account with BOA? Or maybe he used to have a small business (doubt it because we would all know by now?). BOA Accelerated Rewards Amex – The BOA Accelerated Rewards Card has a very dark greyish color that looks like the card the President is carrying. The only issue is that I did not see the bright blue Amex logo at the bottom right on his card. So that means it’s probably not this card? But being a no annual fee rewards card, I can see how the President would have applied for this.

BOA Accelerated Rewards Amex – The BOA Accelerated Rewards Card has a very dark greyish color that looks like the card the President is carrying. The only issue is that I did not see the bright blue Amex logo at the bottom right on his card. So that means it’s probably not this card? But being a no annual fee rewards card, I can see how the President would have applied for this.