Review: Your Credit Score by Liz Pulliam Weston

I am a huge fan of Liz Pulliam Weston, so when I came across her book, “Your Credit Score: How to Fix, Improve, and Protect the 3-Digit Number that Shapes Your Financial Future” I had to it.

I am a huge fan of Liz Pulliam Weston, so when I came across her book, “Your Credit Score: How to Fix, Improve, and Protect the 3-Digit Number that Shapes Your Financial Future” I had to it.

We spend so much time talking about how to build your credit score here at Ask Mr. Credit Card, and I’ve done so much research on the subject, that I wondered, “Will I actually be able to learn anything new from this book?” As it turns out, I did learn a few things, and I’d love to share them with you.

Why Your Credit Score Matters:

The most fascinating information by far in this chapter was a side-by-side comparison of two different credit score scenarios:

In the first example, the woman had a 750 credit score, while the second woman had a 650 credit score. The example tracked them throughout their lives and noted their interest rates each time they got a loan.

Even though this was a fictional example that showed the women getting loans at the same time, and in the same amounts, the woman with the lower credit score ended up paying $320,000 more in interest over the course of her lifetime. Got that number? $320,000. There’s your retirement money, right there! What would you do to avoid paying nearly a third of a million dollars in interest?

Now, obviously the specifics of this scenario do not apply to everyone, but seeing it spelled out really drove the point home – Over time having a lower credit score will force you to pay far more each time you borrow money, whether it is for your house, your car, or your credit cards.

How Credit Scoring Works:

I had no idea that there were more than one hundred different credit scoring systems out there today, and they are nearly all being sold to consumers, or used by lenders.

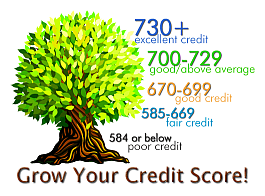

Liz does a good job of going over the basics that make up your score (no matter which system you use). They are:

- Your payment history – Making your payments on time is the most important part of your credit score.

- How much money you owe – This takes everything into account, your mortgage, car payments, credit cards and loans. Even if you never carry a revolving balance on your credit cards, you should still be sure that you never charge more than 30% of your available balances in any given month.

- How long you’ve had credit – The average age of all your credit accounts, and the age of your oldest credit account are what matter here.

- Your last application for credit – This takes into account how much time has passed since you opened your last account, and whether or not you have opened up several new accounts at once.

- The types of credit you use – FICO considers a good mix of credit to be a mortgage, a car loan, and several major credit cards.

Also discussed is the Vantage Credit Scoring System. This is the credit score model that is embraced by the three credit bureaus, TransUnion, Equifax and Experian. Vantage Score is a little stricter than FICO, and if lenders ever do pick it up there may be quite a few people who find themselves suddenly unable to get credit! However for now, lenders don’t seem to be in a rush to ditch FICO, so if you are going to purchase your credit score, it is probably best to just pay FICO to see it, rather than the three credit bureaus.

Improving Your Credit Score the Right Way:

All the basic advice is here, and clearly explained:

- Check your credit report and dispute any errors.

- Pay your bills on time

- Pay down your debt

- Do not apply for credit very often

- Do not close your accounts out, even if you no longer use them

Now all of these things we have covered here at Ask Mr Credit Card, in detail. However, the was one revolutionary bit of advice that made me want to stand up and cheer:

When you focus on paying down your credit card debt, pay down the card with the balance closest to the limit first, and not the card with the highest interest rate.

Now, does this make sense financially? Well, that depends. Normally you would want to pay down the card with the highest interest rate first, to avoid paying the additional interest. However, when you put your credit score above your bottom line, this makes perfect sense.

You might be saying “No, that doesn’t make any sense – why would I want to pay more in interest just to raise my credit score?” Well it goes back to the example from chapter one. Yes, you might pay more in interest for a couple of years until you get your cards paid off – but over the course of your lifetime, you will pay far less than you would if you had not put raising your credit score first.

It really falls under the umbrella of the old Credit vs. Finances debate, and think it’s a pretty brilliant idea.

Besides, if you get your credit score up quickly, then you can always balance transfer cards that have high interest rates, and you will still be better off than you were before.

Credit Scoring Myths:

Liz highlights the ten most common credit score myths, but I want to focus in on just one here:

The myth that you have to carry a revolving balance to raise your credit score.

When I worked for the now-defunct Providian financial, I worked in their collections department. I was instructed to tell people that the correct way to raise their credit score was to carry a balance on their card, and pay the interest every month. At the time, I believed it – now I know better.

Your credit score sees no distinction between carrying a balance on your credit card and paying it off month to month. What gets reported is the amount you charge each month and how close to the limit you are, not the amount you pay down. This is why you should never charge more than 30 percent of your available balance, even if you plan to pay the balance in full the same month.

Rebuilding Your Score After A Credit Disaster:

There is a wealth of information in this chapter. The most important points deal with your rights as a consumer, and Liz Pulliam-Weston goes into great detail on the following topics:

- Rehabilitating a troubled credit account – Many lenders will give you the option of “rehabilitating” your account. This means that if you make a certain number of on-time payments they will voluntarily remove past negative information from your credit reports. This is an excellent strategy for people who have fallen on tough times, made a few late payments, and need that information removed from their credit reports.

- Understanding your right to dispute information on your credit reports , and the best way to do it – including your right to sue a company that continues to place inaccurate information on your credit report. If you have ever been a victim of identity theft, or had a collection account that was sold to several different collection companies, then it’s good to know that you do have legal rights that protect you, and your credit score.

- What you need to know about the statues of limitations – The statues of limitations vary by state, and they determine how long a company is able to sue you over a debt.

- How to get positive accounts put into your credit files – This is something that we will probably talk about here on Ask Mr. Credit Card in the future. Right now, I have one credit card that only reports to two of the credit bureaus. Since I am actively re-building my score, it would benefit me to have it reported to the third credit bureau as well. It turns out the best strategy is to ask your lender to report the account. There is no legal way to force them to report it, but there are times when asking does actually work.

- Get it all in writing – Now, this may seem like basic advice, but it is still sound. Since it’s the electronic age, many of us prefer to use the internet, or a telephone to dispute, or make arrangements with our creditors. Remembering to get all of your important documents in writing will save you a lot of trouble, and money, down the road.

Keeping Your Credit Score Healthy:

This chapter focused not only on good credit practices, but on good personal finance practices as well.

The tips included things like not ing more house than you can afford, having an emergency fund, carrying enough insurance, and keeping your fixed expenses as low as possible. All in all this chapter was not particularly revolutionary, but then, good sound financial advice rarely is.

Many of us roll our eyes when we hear things like “Work hard, keep your expenses low, and pay your bills on time” yet we transfer our money from savings account to savings account just to gain a point or two on our interest rates.

The truth is, if we would follow that time tested advice more often, instead of looking for the magic pill to make our finances better, Liz wouldn’t need to write a book on the subject, and I would probably be out of a job!

Would you recommend this book?

Yes. 100% Yes. I will keep it, and refer to it often as I rebuild my own credit score. There are lessons in this book that are relevant no matter what your financial situation is, but it is an especially good book for anyone who is in the process of paying down their debts, and re-building their credit score. I highly recommend it.

What about you? Have you read this book? Did you like it?

What is your favorite personal finance book? Leave us a comment below!

You can get our future articles on rebuilding your credit score for free when you click here.

Keep Reading:

- How to Raise Your Credit Score In 7 Easy Steps.

- How Does Paying Off A Credit Card Affect Your Credit Score?

- Does Having Too Many Credit Cards Hurt Your Score?

Additional images © Sunnyvale Real Estate Blog, SEO Copywriting.com, Army.mil.