The Carnival of Twenty Something Finances: Money Through The Ages Edition

Welcome to the Carnival of Twenty Something Finances at AskMrCreditCard.com! If you are new here, please pickup our RSS feed, and check out some of the amazing articles below!

Since the beginning of time human beings have bartered, haggled, gambled, and traded items of value to get what they wanted. I think it’s safe to say that as long as money has been around, we humans have developed a real love / hate relationship with it. Sometimes it serves us, sometimes we serve it. With that in mind, I thought it would be fun to take a look back through the ages.

How did we get where we are today?

Our ancestors of a thousand years ago could scarcely envision a stock market – much less a stock market crash or regular cycles of investing! What steps has humanity taken to bring us to this point?

I’ll show you mine if you’ll show me yours: The Barter System

Prior to 9,000 B.C. all forms of trade were done by bartering. There was no currency, no inflation, no “virtual goods”. Everything was traded at face value, according to what the other person was willing to sacrifice to have it. Today bartering is still a valid and time-tested form of commerce in many countries.

The articles below all encompass that “getting back to basics” feel. Since bartering is the first and last form of trade we have available, these are also my editor’s picks. The end, and the beginning, articles of timeless value.

- Stock Market Investing For Beginners has a savvy, no-holds-barred article on some of the common mistakes beginning investors make, and how to learn from them. The article, “Stock Market Education For Beginners – Learning From Your Mistakes” was really refreshing. Most people aren’t willing to reveal their past mistakes like this, much less write a coherent “how not to do it” article about them.

- Lal at Living Almost Large has a killer article called “Walking away from foreclosures” This is something that I’ve never given much thought to, but with the housing bubble collapsing, apparently some people who can afford to pay their mortgages are still walking away from them! Check out the article for the full details.

- Stacey Doyle at The Smarter Wallet gives four simple, perfect steps that teach you How to Protect Yourself Against the Economic Crisis. Short. Simple. Sanity.

- Slow Down Fast offers 6 Ways to Benefit Financially in a Bad Economy. Spot on!

- The Personal Financier gives some of the best marriage and investment advice I’ve ever seen – especially considering today’s markets. You can check out their article: My Recent Experience with a Manic-Depressive Stock Market (One Wife and Three Lessons Learned) for the full story.

Animals: The First Standard Currency

Believe it or not cattle, sheep, camels, and other beasts of burden were the first things to be assigned a standard value for trade. Land, possessions, even marriages were bought and sold depending on how many heads of cattle were offered. A little later on, agriculture was added to the mix: bushels of wheat, and occasionally vegetables could also be offered as part of an agreement. This type of trade thrived between 9,000-6,000 B.C.

The articles below all take somewhat complex topics and distill them down to the real “grain of truth”. The bits of wisdom that you can pick up and take away with you – bits of wisdom to help you plant the seeds of your own future and get fair value for it.

- Free Stock Market Investing Tips wonders, “Is Trading For You?” It was nice to see some wisdom in this article. Trading is not for everyone, and this article gets right to the heart of the matter.

- Until Debt Do Us Part tells us to Laugh in the face of debt! Laughter is the best medicine, and sometimes, that’s all you can do!

- Skyler at Skyler Reep’s Blog puts you in the driver’s seat and hands you the keys to your next job interview with his article Ace Your Next Job Interview. Ever want to know what the suit on the other side of the desk really wants you to say? Here’s your chance.

- Heather Levin at The Greenest Dollar has an excellent article on How to Save Money On Groceries. Practical tips always make it easier to save money, and there are some great ones in this article.

- Trees Full of Money offers up an article on “How to Build Up Your Emergency Fund in a Dismal Economy” The article features 6 tips for building cash fast, as well as 6 tips to get your hands on some cash when you need it.

- The Wedding Manual has a short expose about Tying the Knot in Challenging Times. It’s not always easy, well heck, marriage is rarely easy. It’s a good idea to start with some of these suggestions.

She Sells Sea Shells:

In the totally-blow-you-away department, the simple cowrie shell was used as currency from 1200 BC onward. These humble little seashells saw their first use as currency in China, but they have been used as recently as last century in some parts of Africa. Most of us have probably owned a necklace or a bracelet made of these at one point or another. Did you have any idea that people in ages past would have considered something as simple as those necklaces worth a fortune? I know I didn’t!

The articles below all have the element of surprise. A new twist on an old topic; hidden wealth in the internet-ocean of knowledge.

- The Bargain Queens give us Last-minute Halloween costume ideas: use what you have! Smart advice, and a lot of fun too!

- Craft Stew serves up some Cardboard Furniture Links, as in, how to make your own cardboard furniture, with complete instructions. Wish I’d had this back in college!

- The Shark Investor weighs the pros and cons and decides that you really can Build Wealth By Moving Away. This is something that I am honestly considering in the near future, and I thought this article summed the issues up nicely.

- Debt Prison gives a quick lesson in “How to get a cell phone with no i.d., no passport, and no credit card.” Pay-as-you-go phones are a viable option for a lot of people. They can be cheaper than a regular cell phone plan, and no matter what your credit score is you can still get one.

- Amy Fontinelle at Two Pennies Earned is Traveling to New York City For Cheap. She stayed in New York for a whole week and spent a grand total of $300!

- Budgets Are Sexy has a crafty little article titled It’s Friday, and I’m feeling random. So let’s talk sillyness. The topics might be silly, but they are a sure indicator of the times!

- How I Save Money.net is Having Customer Service Issues At CVS. Good luck as you try to get that resolved with CVS HQ.

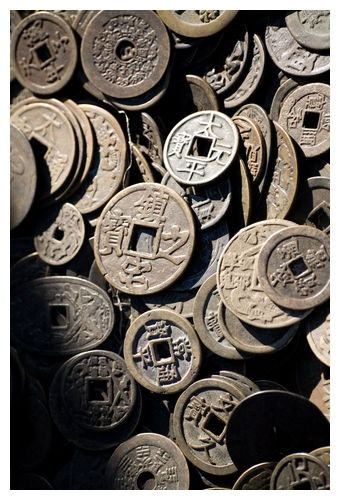

It begins: The first metal coins

The first metal coins were actually cowrie shell reproductions made of bronze or copper.

China began minting them around 1,000 B.C. Over the next 500 years, they gradually evolved into the round “coins” we are familiar with today. These original coins were usually minted with holes in the center so that they could be safely strung together on a chain.

I wonder if this is where the term “chain snatcher” originated? Does anyone know?

The articles below have all taken a simple, natural idea and refined it; minted it into something durable and infinitely usable to suit our purposes today.

- Fire Finance has a bookmarkable article with 12 Tips To Lower Your Heating Bill. I know I’d like my own electric bill to be a bit cheaper! I’ll be trying out a few of these suggestions.

- Military Money Might has an article on “What Should You Do with Certificates of Deposit That Are Maturing? CD Ladder.” This is an excellent strategy! If you are not familiar with it then it is definitely worth a quick read.

- Kanaga Siva at Personal Plug wrote an article about “A Home Based Business — Who, Why, When and Where To Start?” The article definitely covers the pros of starting a home based business at any age or stage of your life.

- KCLau’s Money Tips reviewed a friend’s Ebook, “The Malaysian Insurance Planning Guide by Meshio.com” I’m no expert on insurance – especially Malaysian insurance, but the review was very thorough – it even included a complete outline.

- Alpha Student dishes on Cheap office software for students. You pay enough for your education, right? Spend as little as you can on the assorted goods!

- Mama Bear at I’ve Got A Little Space To Fill is dealing with reality publicly. You can check out her Financial Update for the nuts and bolts of her progress.

- One Family’s Blog gives us all the dirty details in Amazon.com Customer Service – Jeff Bezos backtracks on 30-day price guarantee policy! I’ve had go-rounds with Amazon myself in the past – one good experience, one bad.

“My Precious!”: The first coins made of precious metals, and the early beginnings of the gold standard!

Around 500 B.C. the first coins were minted from lumps of silver, bronze and gold. Lydia (ancient Turkey) Greece, Persia, and eventually the Roman Empire were the first countries to accept this form of currency and make it their standard. These ancient coins were stamped with assorted emperors and gods – probably the first form of trying to prevent counterfeiting!

The articles below are all the “real deal”. They have intrinsic value that goes beyond their time and date stamp. They are minted in the image of their authors, and the knowledge you can gain from them is always a useful currency – measured in more than silver or gold.

- Your Finish Rich Plan has a fun article titled “Recession, Panicking Investors, Stock Market Freefall… What Is Warren Buffett Doing?” There are some wise words in this article, and some genuine good advice to boot.

- Prospering Servant wonders if you are Looking for a Job? Here are 4 Steps to Find a Great One. The steps are simple, and practical – updated advice for today’s job market.

- Master Your Card featured the Bank Collapse Survival Guide. Excellent, and timely info there, eh? A very well done article.

- Brooke at Dollar Frugal submitted “Movies – Snacks in Your Purse?” An article about whether or not it’s right to sneak your own snacks into the movie theatre. If ethics aren’t precious I don’t know what is – but how far are you comfortable toeing the line?

We need an easier form of currency! Paper money gets popular:

Paper money was first invented in China around 800 A.D. The Chinese accepted paper as a form of currency for about 500 years, and then it faded into disuse. It wasn’t until about three centuries later that it actually became the most common form of money throughout China and Europe, and it eventually developed into what we recognize as money today.

The articles below all cover some of the more popular financial topics of the day. Like the establishment of paper money, these articles offer fresh and workable ideas which may well spread to become part of tomorrow’s financial foundation.

- Christian Personal Finance checks in on our 401(k) plans with “My 401k has lost a lot of money – how about yours?” Bob also offers some excellent tips for those about to retire while watching their portfolios shrink.

- Lazy Man and Money takes a periodic look at his Alternative Income Streams – October 2008. I love getting to see what other folks are doing!

- Rich Credit Debt Loan wonders, “Do You Have What it Takes to Be a Millionaire?” They also give the abridged version of what it takes to make that happen.

But What’s a Dollar Really Worth? All Hail The Bank of England!

In 1816 the Bank of England officially made gold the standard that all other values were measured against. They set the official price of gold in order to prevent inflation, and backed their banknotes with a measurable quantity of gold. The United States did the same in 1900.

The articles below are of definite, measurable worth. Many of them are downright innovative; helping to set a new standard for our modern financial difficulties.

- No Debt Plan tells us about How We Prepared for Our First Home Purchase – with a checklist! Easy peasy.

- Sandy Naidu at Future Nest Egg delivers some Warren Buffet Quotes. Good advice from successful people is always priceless.

- Bankruptcy Access has an article on “Bankruptcy Chapter 13“. They really went the extra mile – discussing the differences in the various chapters of bankruptcy and they include tons of links with more information.

- SVB at The Digerati Life tells us how to get a $50 Sign Up Bonus When You Open A TradeKing Account. Now’s starting to look like a good time to invest. Free money would be nice!

- Alan Skorkin at Software, Technology and More gives us the lowdown on How To Save Money As A Student. This isn’t your run of the mill save money article. It’s a bit tongue-in-cheek, but it tells you how to save money on the things you care most about – like alcohol and textbooks.

*Cough* A Dollar’s Worth What You Say It’s Worth: The End of The Gold Standard

What happened to the gold standard? To put it simply, World War I, The Great Depression, and World War II. It was a one-two-three punch that most countries just couldn’t cope with. It was simply impossible to finance the wars, rebuild everything afterwards, and to recover all the damage to the economy.

The United States officially distanced itself from the gold standard in the 1930’s under Franklin Roosevelt in the hopes of easing the Great Depression.

If Roosevelt took the first steps, it was Richard Nixon that took the last. In 1971 he officially severed the link between our currency and gold reserves by “un-fixing” the price of gold. With the price of gold no longer set, it became impossible to measure the value of our money against the value of gold.

The articles below all deal with the economy, and the changes that our government’s making in an effort to restore it. A whole lot of people disagreed with the government when we moved off of the gold standard, and a whole lot of people disagree with the proposed “economic fixes” we are seeing today. I wonder what history will say about it? Are they right to disagree? Are they wrong? What do you think?

- Chasov Blog thinks that the American taxpayers are being Taken for A Ride. He definitely does not advocate federal loans as good ways to bail out failing corporations!

- Praveen Puri at My Simple Trading System is Taking Out The DOG with a quick example of diversification during difficult times.

- Everything Finance is Looking For A College Fund Bailout! He’s not holding his breath on that one, but he does have some excellent suggestions on how to maximize your college savings.

- Credit Help 2 You has a list of 5 Ways To Keep Your Credit Good In Hard Financial Times.

That’s it for the Carnival of Twenty Something Finances! I hope that you have enjoyed reading it as much as I enjoyed putting it together. There were some truly excellent articles featured here, and I want to personally thank everyone for their submissions. I found some new blogs that I had not visited before, and reacquainted myself with a few blogs that were old friends.

I look forward to talking to you all soon. If you like, please feel free to leave a comment below.

Thanks,

Mr. CC