Wells Fargo Debit Card & Check Card Review

Like all banks, Wells Fargo offers their checking account customers a debit card or check card (they are the same). Let’s look at what features Wells Fargo offer for their check card holders and how it stacks up versus other debit cards.

Key Features – Like all check cards, the one from Wells Fargo allows you to use your card just like credit card or use a personal pin number. The card also functions as an ATM card. But there are also additional features.

Transfer money from ATM – You can use the card to transfer money from ATMs

Pay recurring bills – You can use your check card to pay recurring bills (like autopay feature in credit cards).

Visa PayWave enabled – With this feature, you can simply wave the card past a PayWave card reader at a checkout counter without having to sign anything.

Zero Liability for unauthorized transactions – The Wells Fargo check card also provides zero liability protection against unauthorized transactions if you report promptly.

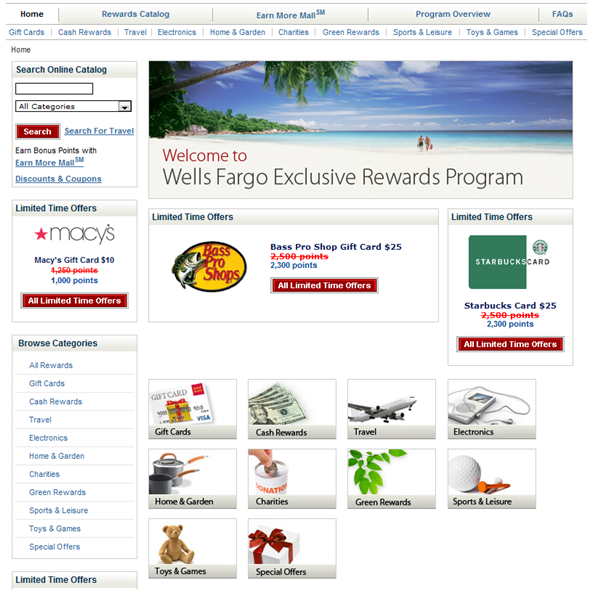

The Wells Fargo offers an optional rewards program for their check card holders. You will have to pay an annual fee of $12. You will earn 1 point for every $4 that you spend on your check card. You are also given an option to earn cash rebates. You will earn 0.25% rebate for every $1 that you spend on the check card. In contrast, if you have a Wells Fargo credit card, you will earn 1 point or 1% rebate for every dollar that you spend. Hence, as with all other check cards, you will earn lesser than with a credit card. How how good is the reward program?

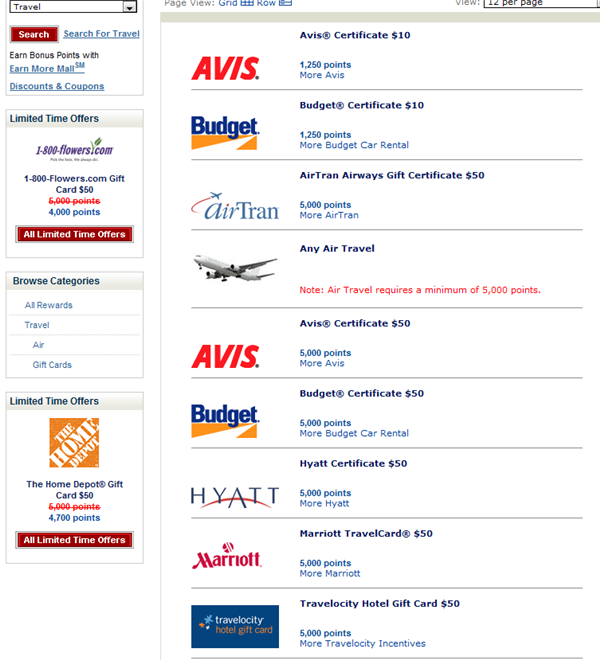

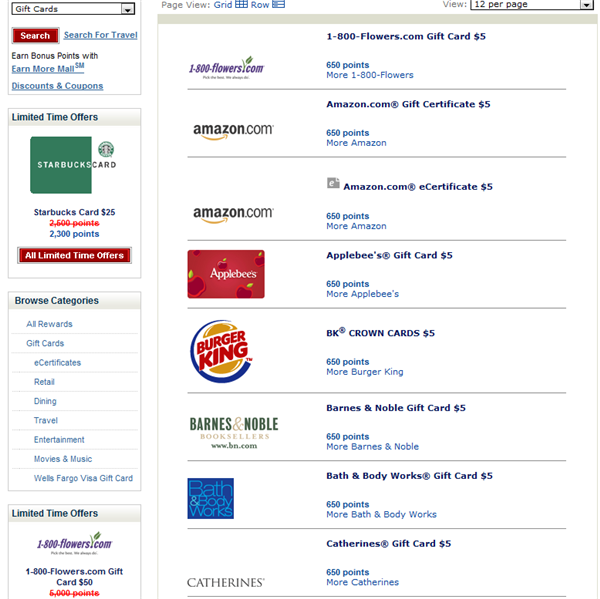

The reward program is actually the same program as the one on their credit card. It has a combination of travel, gift card, cash back and merchandise rewards. The program is “OK” – there is nothing particularly outstanding about it. Below are some screen shots.

Verdict – The Wells Fargo card is a card that any Wells Fargo checking account holder will get. You can choose to use it at the ATM and even as a debit or check card. Question is should you enroll in the reward program. Generally speaking, I’m not a big fan of using check cards or debit cards for earning rewards. Credit cards will earn you much better rewards for the same buck that you spend on a debit card. But there are folks who refuse to use credit cards. For them, I would say that the Optional reward is worth considering since the annual fee of $12 is really low (but bear in mind that you are also only a quarter of the points that a normal credit card would allow you). The travel rewards aren’t really outstanding, but the rest are “OK” or “average”.