Sears Credit Card Review

There are 2 Sears credit card that I will talk about toay. The first is the Sears Store Card (picture above), which only allows you to use the card at Sears and Kmart. This card is primarily geared to folks who do not have good credit.

The other card which I’m going to talk at length is the Sears Gold MasterCard with Choice Rewards (picture above)

Rewards Formula – The Sears Gold MasterCard has two tiers in their reward system. First, there is the regular Sears Choice Rewards Program. There is no annual fee for this version. You will be able to earn one point for every dollar that you spend on the card.

Alternatively, you could enroll in the Sears Choice Rewards Program Select Membership. The Select Membership costs $25. But you get the benefit of being able to earn double points for every dollar that you spend at Sears stores, www.sears.com, Kmart stores, supermarkets, drugstores and gas stations and one point for every dollar spent on all other regular purchases.

Sears Choice Rewards Points have a three year expiration date.

Rewards – The Sears Choice Rewards allows you to redeem points for a variety of rewards like travel, merchandise and gift cards. The rewards are just OK and not as comprehensive and regular credit card reward programs. Below are screen shots of the rewards and links to some of their reward pages.

To see all their gift card rewards, you can go to this page. The thing that I do not like about their gift card rewards is that you need 2500 points for a $20 gift card (technically less than 1% payout), whereas a program like the membership rewards only require 2000 points for a $20 gift card.

Verdict – If you have bad credit and are looking for a store credit card, perhaps you can consider Sears. But the problem with all store cards is that you can only use them at the store (Sears and Kmart). You might want to consider getting a secured credit card instead, which can be used anywhere. I am not too impressed with the credit card. Yes, you can earn double points at Sears, Kmart and their affiliated stores but you need to pay an annual membership fee of $25 for the Choice Rewards Select Members Program. The reward program is not exactly not notch either.

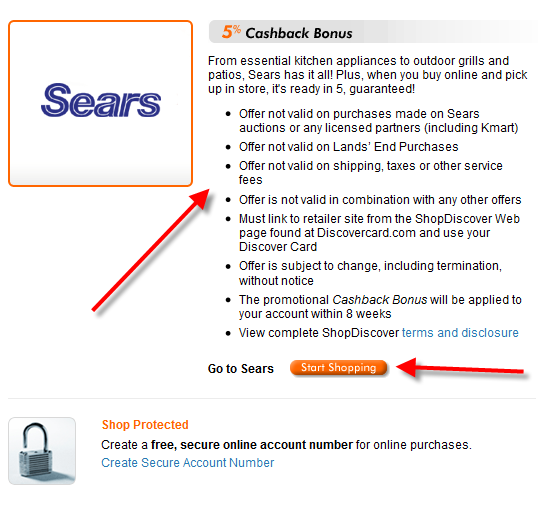

Alternative – As an alternative, I am going to highlight another card that lets you earn 5% rebates every time you shop at Sears.com. That card is the Discover More Card. Discover has a shopping portal called shopdiscover.com. If you access sears.com through your account, and use your Discover Card to stuff online there, you will earn 5% rebates (I look at them more like discounts). Below are some screens shots of how it works. First, go to the shopdiscover.com partner page and search for Sears.

Once you find the Sears button, click it and it will take you to the page which list the rules and fine prints.

Click on the start shopping button and it will take you to the Sears.com site.

Here’s another point: Sears also owns Landsend. For the Sears Store Card or MasterCard does not allow you to shop at Landsend or earn double points (in the case of the MasterCard). But with the Discover Card, Landsend is a partner merchant and you can get 10% rebates when you shop at Landsend.com through your Discover Account. Hence, I highly recommend getting the Discover More Card rather than the Sears Credit Card.