Saving for Your Child’s Education with UPromise

About a month ago, I decided to give UPromise a go. My daughter’s young, (she’ll be two in December) so we have a while to save for her college fund.

We’ve already started a Coverdell account for her, to take care of her early school years because we want to put her in a private school. I hadn’t actually started her an official college account though. So when I ran across UPromise, I thought I would check it out, and see what it was all about.

I thought it might be fun to do a review-in-pictures, so I included some screen shots below!

This is the UPromise main page – where you’ll end up if you want to check the program out a bit. I started my account with them in September, because I got a five dollar sign on bonus. I haven’t really been actively trying to accumulate money in the account, I just set it up, and gave it a couple of months to do it’s thing.

So far, I have $8.64 in the account. Not counting the $5.00 sign on bonus, it means that I’ve earned $3.64 towards my daughter’s college fund. Certainly not earth shattering! But, considering all that I did was to list my Kroger card number with UPromise, and make my regular purchases, I don’t think that’s too shabby.

If I earn a dollar a month, for the next 16 years (assuming I do nothing differently than I am now) that’s $192.00. I am assuming that *might* a textbook in 2024. Maybe. An undergrad textbook.

So, clearly, this is nice, but if that were all the program offered, I probably wouldn’t waste my time.

One thing that does help though, is that you have the ability to invite friends and family members to join you on UPromise. And they don’t spam them to death either – as far as I can tell. At least, no one has complained to me about it yet.

So, you get your family in on the deal, and they allocate their rewards to your child. This is great for me, since my dad is big into EBay (We will get 1% of all his purchases) and my mom shops online (1-10% back depending on where she shops). If we all throw our Kroger cards in there, I can see how the savings could build up a bit over time. And hey, it’s free money. The only work I had to do was sign up and list my Kroger card.

As I said though, this isn’t the biggest benefit of UPromise in my opinion. Free money is good, but this is better:

What sold me, lock, stock, and barrel was that little logo at the bottom – UPromise has partnered with Vanguard to offer low cost 529 plans.

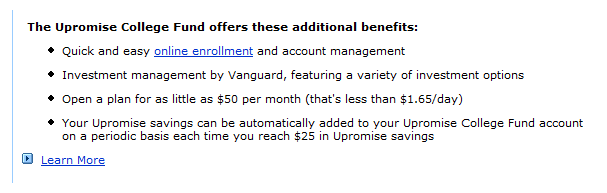

Here’s a few more details:

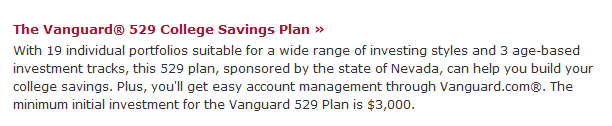

So. That’s a pretty sweet deal considering the last time I browsed around Vanguard’s website, their 529 requirements looked like this:

So, frankly, I don’t have $3,000 to cough up all at once to start my daughter’s college account. I wish I did, but I don’t. But if I go through UPromise, I start the account with $200, and contribute a regular $50 a month. Then, anytime my UPromise account hits $25 or more, they will roll it on over into the 529 account for me. Easy Peasy.

UPromise has also partnered with Citi to offer a rewards credit card. It has decent terms, and the rewards go into your UPromise account:

Basically you can earn 10% back when you shop through their approved retailers, and 1% back everywhere else.

As far as their “approved retailers” go, it really is a large list. There are more than 600 stores and travel sites to choose from. Here’s a few to give you an idea:

- Target

- Priceline.com

- Walmart

- Williams-Sonoma

- Amazon.com

- Bluefly

- FTD.com

Honestly though, this is not the type of credit card you want to carry a balance on. Just like any cash back credit card, if you carry a balance from month to month the interest that you pay will completely negate any benefits you get from using the card.

If you normally carry a balance on your cards, you’d probably be better off just chucking an additional $10 or $20 into the college account itself, rather than paying interest to Citi just to get a few dollars in rewards.

All in all though, I’m thrilled. I have to admit, I think this is going to be a valuable program. I do have one BIG gripe though, and thankfully, it is an optional feature.

UPromise has a tool bar that you can download. When you jump online, you log in, and it will show your current savings. What it also does though, is to automatically use the UPromise affiliate link when you visit one of the 600 partner sites. That way you can be sure that you will get your rewards back when you shop there.

The only problem is, I’m one of those people who likes to browse. So, if I get an email from Amazon, and I click on the link, I get redirected through UPromise temporarily. My gripe here is, when the toolbar is active it sends me through UPromise, and then redirects me to the front page of the partner site – not to the page I was trying to visit. In other words, I’ll click a link for a sweater, and end up on Amazon’s front page instead.

Well, after about a month of that, I uninstalled the little bugger, and put a few expletives in the comments section of the uninstall. Hopefully Upromise will fix that feature as soon as possible.

So, that’s my only warning. If you browse a lot, do NOT install the toolbar. Just visit UPromise any time you actually expect to something online. They have so many affiliate sites that chances are, you’ll find what you need at one of them, and be able to get some money back on your purchase for your child’s education.

So, I guess my next question would be, why in the world can’t we do this with our retirement accounts? 🙂

Have a question for us? Leave a comment below!

Keep Reading: