PNC Bank Visa Check Card

The PNC Bank Visa Check Card is a check card (or debit card) that is issued to folks who have a checking account with PNC bank. Let’s find out more about this card.

The PNC Bank Visa Check Card is a check card (or debit card) that is issued to folks who have a checking account with PNC bank. Let’s find out more about this card.

From what I can tell from their website, there are a few features that are worth noting about this card:

Visa PayWave – This check card has the Visa PayWave techonology embedded in it so you can simply pay your bills at the checkout counter by waving your card over a “paywave enabled” device (if the store has one).

Visa Protection – This check card offers some decent protection for non-PIN purchases made from your checking account (PIN based transaction means you simply choose “credit” and not debit when you swipe your card. You’re not responsible for verified unauthorized purchases should your card be lost or stolen. You also have Visa protection in case of a merchant dispute or fraud.

PNC Rewards – Perhaps, this is the most interesting feature is that PNC actually has a reward program for their check card. But how good is it? Let’s find out.

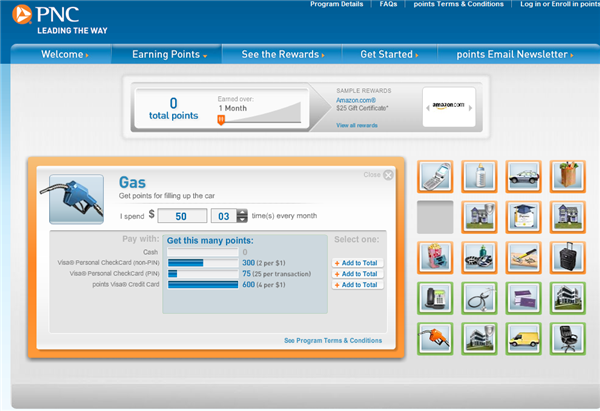

The PNC rewards actually lets you earn more than one point for every dollar that you spend depending on the type of expense it is. Below is a screen shot that shows you all the category of expenses that will earn you extra points.

I took a screen shot of the gas expense as an example. When you use the card as a Non-PIN transaction, you will earn double points for every dollar you spend on gas. If it is a PIN based transaction, you earn 25 points per transaction. And they also show that if you have an actual PNC credit card with the PNC rewards, you earn 4 points for every dollar you spend on gas (charged to your card).

So it appears that at first glance, this reward is great for earning points. How then, how many points does it take to redeem rewards? Let’s find out.

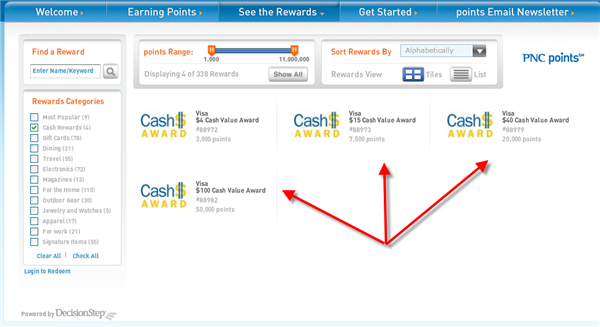

When I looked across the different categories on how many points it takes to redeem rewards, I was a little disappointed. The benchmark I use is the standard 1% (ie 100 points gets you about $1 worth in rewards). If you look at the screen shot with cash back page. To get $15 in cash rebates, you need 7,500 points! Yikes – most programs will require only 1,500 points! I then looked at the gift card section and I saw the same thing. A $10 gift card requires 5,500 points! The best programs like Membership Rewards require only 1,000 for a $10 gift card. Even programs like Citi’s ThankYou which has devalued their rewards a little require 1,500 points for a $10 gift card. Then, I checked out the travel section. For a $250 flight discount, you need 100,000 points! Outrageous!

PNC will probably point out that you can earn extra points with more categories than other check cards. That is true. And there is also no annual fee (which many other check cards have – especially those with rewards).

Verdict – While the PNC Visa check card allows you to earn more than one point for every dollar that you spend on more categories of expenses, you need heck of a lot more points to redeem rewards compared to regular credit card reward programs. But is that a fair comparison? Probably not. Reward programs for debit cards are typically less generous than regular credit card programs. So my opinion is that if you love PNC and bank with them, and you are not the sort of person that uses credit cards, then I guess using this card is better than a regular debit card that has no rewards. But do not get too excited because you need a lot of points to redeem a similar reward compared to credit card reward programs.

If you have lots of money in the bank and use your debit card a lot, then you are leaving “reward points” on the table. It would be interesting to see how the PNC Rewards treat their credit card holders. But that will be another review for another day.